Generally, we want to offer your shares to own 55, but the very anyone try happy to shell out try 53.50. For many who wished to sell the fresh offers right away, you would need to accept less cash on the offers than simply you might be able to get throughout the normal market times, if there is a lot more exchangeability in the business. For many who made a decision to keep limitation buy speed in the 55, the possibility you’ll are present that your particular order may possibly not be performed, entirely or in area. Particularly, buyers can only explore limit purchases to shop for or offer offers.

Immediate ai trading | After-Instances Trading: The goals, The way it operates, and you may Times

- Very long hours trading ‘s the identity familiar with consider each other post-business (after-hours) and you may pre-business (before-hours) trading.

- Throughout the the individuals occasions, individuals from the neighbors to the world’s premier institutional buyers buy and sell stocks in pursuit of their financial desires.

- After-times trading is a little distinctive from normal change to the exchanges throughout the day.

- After-occasions change lets buyers purchase and sell securities anywhere between 4pm and 8pm EST as a result of digital systems, often leading to lower liquidity and better volatility.

- Over the past twenty years, Steven have held multiple ranks inside the global forex segments, from creating to help you asking so you can offering while the a registered product futures associate.

This leads to high price volatility minimizing liquidity, which can raise risk. Even as we’ve detailed, development can disperse a stock’s rate inside immediately after-times change. So you might consider your’re getting a good rate, you will probably find on your own to your shedding prevent of one’s positions in the event the segments rapidly opposite the newest stock’s rates for the almost every other, in addition to this (or worse) information. Yet not, market professionals whom choose to trading within these lengthened classes is always to be aware that the new pre- and blog post-industry fictional character may vary rather regarding the normal day class. Despite when you wish so you can trade you need a brokerage membership to accomplish this. Not all the agents render just after-occasions trading, therefore if this really is a component you’lso are looking, you’ll need to determine if it is available at the start.

Seeking to search carries?

Mychal Campos, Direct from Spending at the Improvement, likens that it to truth be told there becoming a lot more “sensuous requires” related to the business, that will move an inventory’s rate. “You can find for the an inventory after normal office hours and benefit from you to definitely spike in cost, but you’lso are introducing you to ultimately exposure when the business opens up the newest 2nd early morning,” claims Campos. If the prior time’s great actually starts to pattern maybe not-so-a great 24 hours later, you may be considering a huge drop in expense and bear losings. What number of traders trade after normal office hours try a fraction of those people change during the typical business instances.

However, after-days change each other enhances the simple risks of the market and you can brings up a lot more dangers. Through the just after-instances trading, there’s a decrease in market interest the inventory being replaced. This immediate ai trading will trigger increased expense volatility and you may decreased exchangeability, which can intensify chance. Away from earnings launches in order to company scandals, news catalysts can create plenty of change options. That have weak exchangeability comes large change costs, complications with establishing positions, and uncertainty up to cost. This may mean much more chance to have date traders who need short, time-delicate actions.

But not, with once-times trading, all of the investors have the option from bringing their online game to your overtime. Needless to say, it reveals of a lot opportunities, however should be familiar with the dangers. When you’re also exchange carries, one of the greatest requirements would be to always get the best you are able to rate according to their trade plan. But if you get otherwise promote stocks after normal office hours, that it doesn’t usually takes place.

“Which milestone represents exactly what the real believers, out of merchandising buyers in order to institutional investors to the personnel and lovers, understood the collectively,” told you Chief executive officer Brian Armstrong. A newsletter designed for industry lovers by industry fans. Best stories, better moving companies, and exchange details taken to their email all weekday ahead of and after the field closes.

Expulsion in the standard is also weighing to the inventory rates, since the list financing promote offers to straighten for the S&P 500’s the new structure. After-instances change allows buyers buy and sell ties between 4pm and 8pm EST as a result of digital sites, often leading to down liquidity and better volatility. The fresh availableness hinges on the brand new broker and the specific stock’s trading frequency. Stepping into once-instances change will be part of a broader funding means. Because of the participating in one another regular and you may immediately after-occasions locations, people is diversify their method, capitalizing on various other market standards and you may personality to optimize their portfolio performance. Since the once-instances change is actually shorter generally experienced than typical change, less people would be energetic during this time.

What’s After normal office hours Trade?

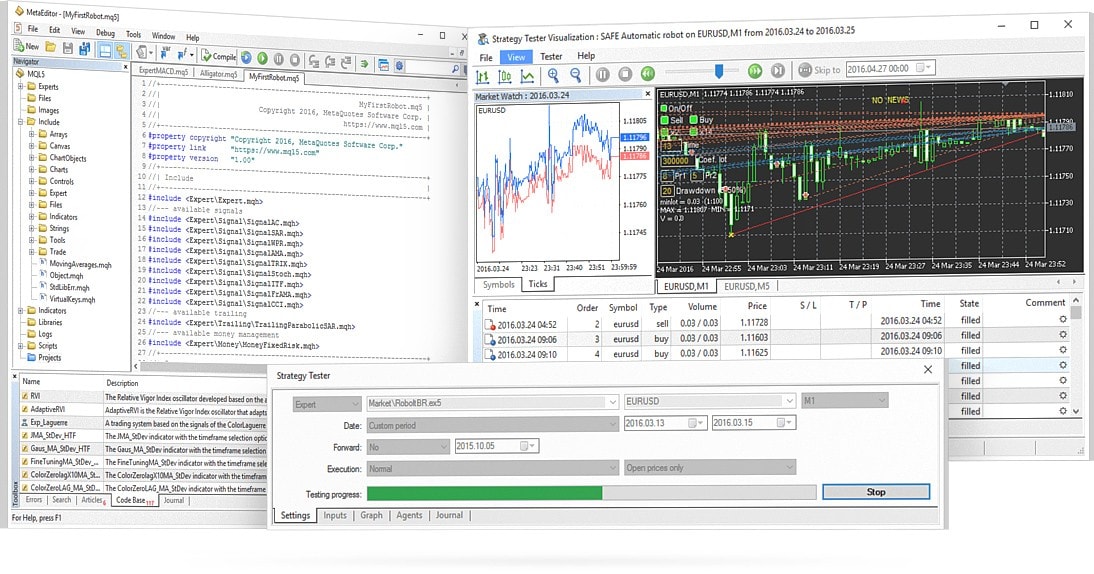

Extended exchange training fool around with Digital Communications Sites (ECNs). So it framework can cause speed inaccuracies across the other programs. The fresh inconsistency within the asset rates after hours lets investors and discover better selling or buying conditions. This type of criteria might not be available throughout the regular exchange training.

No hay productos en el carrito.

No hay productos en el carrito.